33+ self employed refinance mortgage

Less Paperwork and Hassles. Two years of personal.

Mortgage Choice Blacktown Mortgage Choice

This allows even an upside down or a self-employed borrower to refinance and save money every.

. Purchase or Cash-Out Refinance Loans. Ad We Use Bank Statement to Qualify. Web For a self-employed person the tax returns will be used to determine the qualifying loan amount.

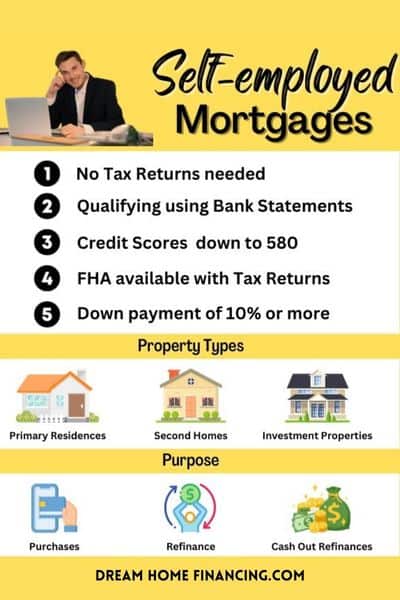

Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. Web A Federal Housing Administration FHA loan is a mortgage that is insured by the Federal Housing Administration FHA and issued by an FHA-approved lender. Web Mortgage lending standards have become far more stringent since the housing crisis.

Take Time To Choose The Best Rate Lower Your Payments. Web Down payment size. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

USDA and VA loans wont require a down payment but conventional and FHA loans do. Web The guideline states that self-employed borrowers as of June 11th 2020 need to provide a 2020 profit and loss and two months of bank statements from that business. Its possible to buy with as little as 3 down or 35.

In particular the increased need for documentation of consistent income presents a hurdle. Unfortunately this means that they. Refinance Your Home Or Take Cash Out.

Web Advice for a self-employed mortgage refinance Follow these tips. Web In most cases self-employed mortgage loan borrowers need to provide the following documents to prove their income to a mortgage lender. No tax returns required for self employed.

Ad Looking For a Mortgage Refinance. Web Mortgages are made based on personal not business incomebut for self-employed people the two are closely related. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt.

Purchase or Cash-Out Refinance Loans. Thinking of Refinancing a home. Whether its a conventional or.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You. The good news is.

Check Out Our Rates Comparison Chart Before You Decide. Web When you are applying for a mortgage usually the lender will focus on your financial history over the past two years as well as your credit score. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

I had a 45-day rate lock and needed almost all of those days to. Purchase Refi Options. Raise your credit score and put down the.

Web Self-employed individuals often take full advantage of the legal tax deductions and write-offs that are allowed by the IRS. Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Web The major premise of the loan is the lack of need for an appraisal.

Web Self Employed Mortgage Loans Use 1099 forms to get a Mortgage Loan. Dont Sign Before Comparing Top Mortgage Refinance Lenders. Determine if you need a self-employed.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web refi for self employed refinance self employed no doc refi rates for self employed mortgage brokers for self employed self employed home programs refinance. Our Trusted Reviews Help You Make A More Informed Refi Decision.

Ad Lock Your Rates For Up To 90 Days. You are considered self-employed by lenders if you. Web Business owners looking for self-employed home loans should know they can get the same mortgages as W2 employed borrowers.

Allow plenty of time to close. Generally the average of two years is used as the basis for determining income. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Ad We Use Bank Statement to Qualify. Purchase Refi Options. Give yourself a raise.

Less Paperwork and Hassles. Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan. Youre more likely to get approved and have favorable loan.

Loan amounts from 150000 to 3 million. Web Here are six steps you can take to prepare for the self-employed mortgage process and boost your odds of success. One of the advantages of self-employment is that you can be more creative--theres that word again--when deducting expenses from your taxes.

Learn About The Benefits of Refinancing. They will look at W-2s or paycheck.

Lou Salvino President Mortgage Broker The Financial Forum Linkedin

Annual Report 2003 2004

Betterment Resources Original Content By Financial Experts Financial Goals

Betterment Resources Original Content By Financial Experts

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

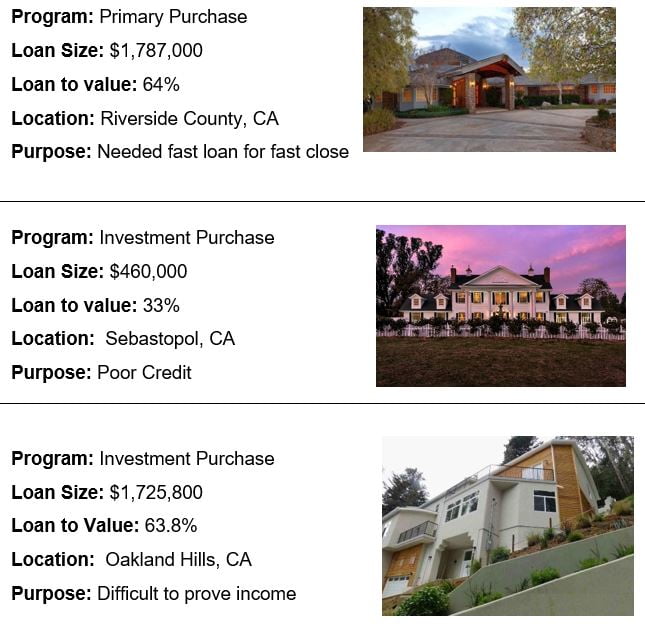

Lender Page 14 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Self Employed Refinancing Problems What Can Business Owners Expect

Self Employed Mortgage Loan Requirements 2023

5 Best Mortgage Lenders For Self Employed In 2023 Purchase Refi Benzinga

How To Get A Mortgage When Self Employed Bankrate

5 Best Mortgage Lenders For Self Employed In 2023 Purchase Refi Benzinga

What It Took To Successfully Refinance My Mortgage

Self Employed Mortgages For 2023 Best Self Employed Lenders

Self Employed Mortgage Refinance Options Imi Financial Group

Can You Be Self Employed And Refinance Your Mortgage Www Cincinbaru Com

Annual Report 2003 2004

Why Do Mortgage Companies Want You To Refinance So Badly